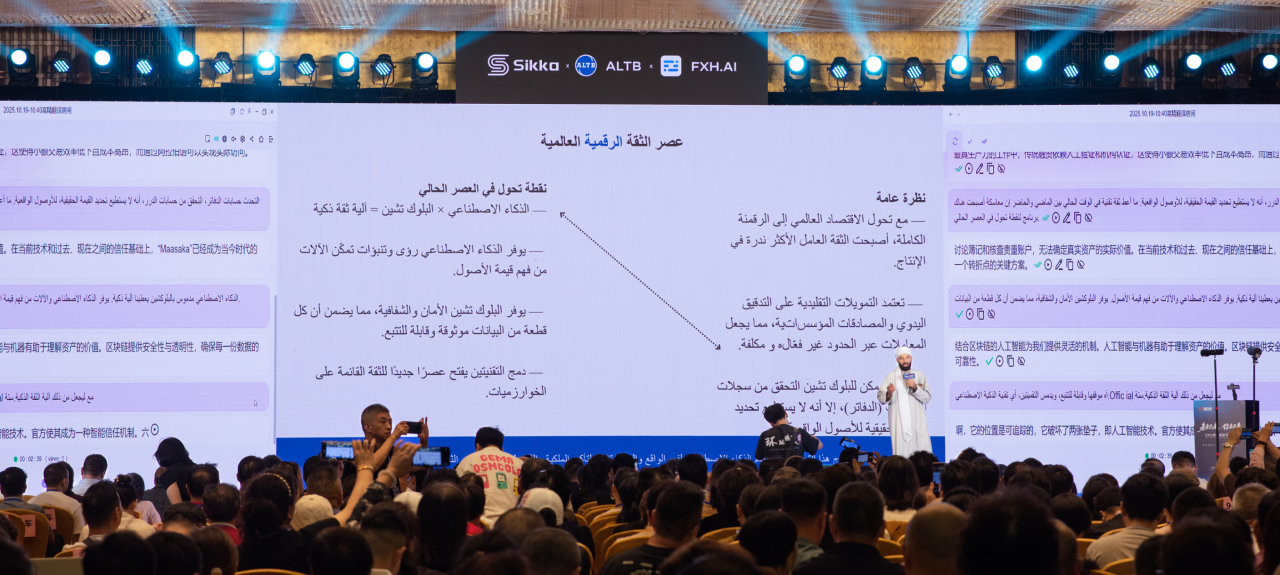

Sikka Public Chain Debut | Grand Appearance at Asia RWA × AI Summit, Opening a New Phase of Intelligent Compliant RWA Infrastructure

According to the official report from FXH.AI, on October 19, 2025, the '2025 Asia RWA × AI Summit Forum' co-hosted by FXH.AI successfully concluded in Hainan. As a key technical release segment of this summit, the new-generation enterprise-grade public blockchain for real-world assets (RWA) — Sikka made its global debut, simultaneously releasing its technical whitepaper, formally showcasing its strategic path of building a global digital trust infrastructure through the integration of AI × blockchain.

RWA is Entering the Era of Intelligent Compliance

At the debut event, Sikka Global Ambassador Haddad Oussama stated that the roadmap for global asset digitization has moved from 'tokenization attempts' to the stage of 'compliant and auditable infrastructure construction'. Past encryption attempts failed to address the issues of trust sources and regulatory embedding; for RWA to achieve institutional-scale adoption, it must have an underlying network that is compatible with regulation, verifiable, secure, and traceable.

"The significance of Sikka's emergence is not to put assets on-chain, but to have assets recognized, audited, and adopted by institutions on-chain."

—— Sikka Global Ambassador Haddad Oussama

From 'Assets Can Be Put On-Chain' to 'Assets Can Be Accepted by Regulatory Agencies'

Sikka clearly positions itself as an AI-driven digital trust infrastructure, with its core competitiveness stemming from the integration of three technical pathways:

- AI intelligently participates in real asset valuation and authenticity identification

Through model fingerprinting and verifiable evidence package mechanisms, AI outputs are no longer a black box but verifiable and trustworthy inputs.

- Blockchain provides an auditable and trustworthy ledger, not just for evidence storage

Using BFT-PoS + BLS signature systems and a dual-layer verification structure, every RWA transaction has replayability and provability.

- Replacing 'information disclosure' with 'proof of compliance'

Sikka's ZK-KYC / KYB and SPDL policy language enable institutions to complete compliance verification without exposing sensitive data.

This design makes Sikka an 'institutional-grade hub' between traditional finance and open finance, allowing compliance without sacrificing privacy and enabling audits without relying on manual endorsement.

The Industrial Pathway for RWA + AI is Taking Shape

At the forum, the Sikka Global Ambassador pointed out that the digitization of real-world assets is not a technical issue but a 'trust reconstruction problem'. The addition of AI allows asset values to be understood by machines, and blockchain enables this understanding to be verified and recorded, combining to form a new 'Algorithmic Trust Layer'.

The release at the forum marks that the RWA narrative has moved from 'whether it can be done' to 'by what standards and who endorses it'. The launch of Sikka provides institutions with the first standardized infrastructure sample that can be used for real asset issuance, cross-border circulation, and compliance integration.

Outlook: Starting from Dubai, Connecting to the Global Financial Backbone

With the launch of the Sikka mainnet and the opening of ProofHub and compliance SDK, Sikka will advance global ecosystem development for financial institutions, asset management companies, and enterprise nodes, forming an industry-level AI audit and compliance alliance. Haddad stated: "RWA is no longer a theme in the crypto industry but the next infrastructure market for global finance. Sikka's role is to allow the real-world credit system to continue on-chain — not to reinvent credit."

The debut of Sikka marks RWA's official entry into the era of intelligent, compliant, and verifiable infrastructure. The next phase of global digital assets is not about expansion based on hype, but about landing based on trust.